In Payables, You can set tolerance for Purchase Order Matching and Tax Override.

Purchase Order Matching/Invoice Tolerances

Use the Invoice Tolerances window to define the matching tolerances you want to allow for variances between invoice, purchase order, and receipt information. You can define both percentage-based and amount-based tolerances.

If you enter a zero for a percentage tolerance and enable the check box for that tolerance, Payables will not allow any variance at all. If you want a low tolerance, you can enter a very small percentage. If you enter no value, then Payables will allow infinite variance. If you enter an amount-based tolerance, enter all amounts in your ledger currency. If an invoice exceeds these tolerances, Invoice Validation will apply a hold to it.

Navigation Path: Payables->Setup->Invoice->Tolerances

Tax Tolerances

Tax tolerances are used to determine whether E-Business Tax places a tax hold on an invoice due to the

override of calculated tax lines.

A tax tolerance is the acceptable variance between the calculated tax amount on an invoice and the override tax amount entered by the user. If the variance between these two amounts exceeds the tolerances you specify, then E-Business Tax places the invoice on hold. To define tax tolerances, you must first set the Allow Override for Calculated Tax Lines option.

Navigation Path: Payables->Setup->Options->Payables Options->Invoice->Tax Tolerances

Monday, November 30, 2009

What is Distribution Set and How to define Distribution Sets?

Specify a distribution set for the invoice. A distribution set is a template for invoice distributions. When you specify a distribution set for an invoice, Payables automatically creates invoice distributions based on the distribution set.

There are two types distribution sets

Full Distribution Set

Skeleton Distribution Set

Creating Full and Skeleton Distribution Sets

Navigation Path: Payables->Setup->Invoice->Distribution Sets

There are two types distribution sets

Full Distribution Set

Skeleton Distribution Set

Creating Full and Skeleton Distribution Sets

Navigation Path: Payables->Setup->Invoice->Distribution Sets

What is Payment Terms and How to define Payment Terms?

Payables uses payment terms to automatically calculate due dates, discount dates, and discount amounts for each invoice you enter. Payment terms will default from the supplier site. If you need to change the payment terms and the terms you want to use are not on the list of values, you can define additional terms in the Payment Terms window.

Defining Payment Terms

Example: Payement Term - 10/30 Net 45

Your supplier has just notified you that they are going to offer 10% discount if you pay their invoices in 30 days. The entire invoice amount will be due in 45 days. In this case, you will set up payment terms as follows.

Navigation Path: Payables->Setup->Invoice->Payment Terms

Defining Payment Terms

Example: Payement Term - 10/30 Net 45

Your supplier has just notified you that they are going to offer 10% discount if you pay their invoices in 30 days. The entire invoice amount will be due in 45 days. In this case, you will set up payment terms as follows.

Navigation Path: Payables->Setup->Invoice->Payment Terms

Types of Value Sets

You can define several types of value sets depending on how you need your values to be checked. All value sets perform minimal checking; some value sets also check against the actual values, if you have provided any.

Navigation Path: System Administrator->Application->Validation->Set/Values

None - A value set of the type None has no list of approved values associated with it. A None value set performs only minimal checking of, for example, data type and length. Examples of such values include credit card numbers, street addresses, and phone numbers.

Independent - Use the validation type Independent when you know the allowable values ahead of time. Independent type value sets perform basic checking but also check a value entered against the list of approved values you define.

Dependent - A Dependent value set is also associated with a list of approved values. In this case however, the values on the list can be grouped into subsets of values. Each subset of values is then associated with a value from an Independent value set. Once a value from the Independent value set has been specified, the list of values for the Dependent value set displays only the values that are approved for the value selected from the Independent value set.

In below picture, once a value from the Category value set has been specified, only the appropriate values from the Item value set are displayed.

Table - Table value sets obtain their lists of approved values from existing application tables. When defining your table value set, you specify a SQL query to retrieve all the approved values from the table.

Special - This specialized value set provides another flexfield as a value set for a single segment. Special value sets can accept an entire key flexfield as a segment value in a descriptive flexfield or report parameter.

Pair - This specialized value set provides a range flexfield as a value set for a pair of segments.

Translatable Independent - Translatable Independent value sets are similar to Independent value sets except that translated values can be displayed to the user. Translatable Independent value sets enable you to use hidden values and displayed (translated) values in your value sets. In this way your users can see a value in their preferred languages, yet the values will be validated against a hidden value that is not translated. A Translatable Independent value set can have only Translatable Dependent value sets dependent on it.

See Example: Appliances and Furniture can be displayed in two languages (Gerate and Mobel) or (Appareils and Meubles).

Translatable Dependent -Translatable Dependent value sets are similar to Dependent value sets except that translated values can be displayed to the user. Translatable Dependent value sets enable you to use hidden values and displayed (translated) values in your value sets. In this way your users can see a value in their preferred languages, yet the values will be validated against a hidden value that is not translated. Translatable Dependent value sets must be dependent on a Translatable Independent value set.

See Example: Appliances and Furniture can be displayed in two languages (Gerate and Mobel) or (Appareils and Meubles). Microwave can be displayed in Mikrowellenherd or Four a micro-ondes.

Navigation Path: System Administrator->Application->Validation->Set/Values

None - A value set of the type None has no list of approved values associated with it. A None value set performs only minimal checking of, for example, data type and length. Examples of such values include credit card numbers, street addresses, and phone numbers.

Independent - Use the validation type Independent when you know the allowable values ahead of time. Independent type value sets perform basic checking but also check a value entered against the list of approved values you define.

Dependent - A Dependent value set is also associated with a list of approved values. In this case however, the values on the list can be grouped into subsets of values. Each subset of values is then associated with a value from an Independent value set. Once a value from the Independent value set has been specified, the list of values for the Dependent value set displays only the values that are approved for the value selected from the Independent value set.

In below picture, once a value from the Category value set has been specified, only the appropriate values from the Item value set are displayed.

Table - Table value sets obtain their lists of approved values from existing application tables. When defining your table value set, you specify a SQL query to retrieve all the approved values from the table.

Special - This specialized value set provides another flexfield as a value set for a single segment. Special value sets can accept an entire key flexfield as a segment value in a descriptive flexfield or report parameter.

Pair - This specialized value set provides a range flexfield as a value set for a pair of segments.

Translatable Independent - Translatable Independent value sets are similar to Independent value sets except that translated values can be displayed to the user. Translatable Independent value sets enable you to use hidden values and displayed (translated) values in your value sets. In this way your users can see a value in their preferred languages, yet the values will be validated against a hidden value that is not translated. A Translatable Independent value set can have only Translatable Dependent value sets dependent on it.

See Example: Appliances and Furniture can be displayed in two languages (Gerate and Mobel) or (Appareils and Meubles).

Translatable Dependent -Translatable Dependent value sets are similar to Dependent value sets except that translated values can be displayed to the user. Translatable Dependent value sets enable you to use hidden values and displayed (translated) values in your value sets. In this way your users can see a value in their preferred languages, yet the values will be validated against a hidden value that is not translated. Translatable Dependent value sets must be dependent on a Translatable Independent value set.

See Example: Appliances and Furniture can be displayed in two languages (Gerate and Mobel) or (Appareils and Meubles). Microwave can be displayed in Mikrowellenherd or Four a micro-ondes.

MOAC in Concurrent Programs/Reporting

A new field "Operating Unit Mode" is added in the Define Concurrent Programs in the OA Framework pages. The user can query the program or report based on an operating unit by updating the "Operating Unit Mode" field with one of the following values:

- Single

- Multiple

- Empty

The multiple organizations context is automatically initialized by the concurrent program if the "Operating Unit Mode" is set to either Single or Multiple. The user can also select a value from the Operating Unit field's LOV in Request form when the mode is Single. The value of the "Operating Unit Mode" must be Single for a majority of the existing operating unit context sensitive reports. Example: Invoice Register report.

In case of Multiple, Operating Unit field in Request page will be disabled, it indicates that CP will run for all user accessible OUs. You can also define Operating Unit field as a input parameter for CP. In this case you can run CP for selected OU or for all. Example: Invoice Validation report.

**You should not change "Operating Unit Mode" of any reports which are owned by Oracle. Use this option for user defined reports only.

Navigation Path: System Administrator->Concurrent->Programs Here select Request tab. There u can see "Operating Unit Mode".

Query to check this option from back-end:

SELECT concurrent_program_name, multi_org_category

FROM fnd_concurrent_programs

WHERE concurrent_program_name =

S-Single

M-Multiple

null-Empty

Thursday, November 26, 2009

Defaulting Operating Unit in MOAC

1.If the profile option 'MO: Security Profile' is set and gives access to multiple Operating Units, then the profile value of 'MO: Default Operating Unit' will be defaulted, if this value is validated against the list of Operating Units in 'MO: Security Profile'. i.e. If the Operating Unit is included in the security profile then it is returned as the default value. Otherwise there is no Operating Unit default. Also, if the Profile Option 'MO: Default Operating Unit' is not set, then there is no default Operating Unit.

2.If the profile option 'MO: Security Profile' is set and gives access to one Operating Unit, then default Operating Unit will return this value even if 'MO: Default Operating Unit' is set to a different value.

3.If the profile option 'MO: Security Profile' is not set, then 'MO: Operating Unit' value will be used as the default Operating Unit even if 'MO: Default Operating Unit' profile is set to a different value.

2.If the profile option 'MO: Security Profile' is set and gives access to one Operating Unit, then default Operating Unit will return this value even if 'MO: Default Operating Unit' is set to a different value.

3.If the profile option 'MO: Security Profile' is not set, then 'MO: Operating Unit' value will be used as the default Operating Unit even if 'MO: Default Operating Unit' profile is set to a different value.

MOAC functions

MO_GLOBAL Package

MOAC functionality is provided through the MO_GLOBAL package (AFMOGBLB.pls). Following are some of the more important functions and procedures in the package.

Init() This is generally called by forms and reports to setup the list of orgs that can be accessed. It calls the set_org_access procedure, which in turn calls populate_orgs. This inserts the orgs a user is allowed to access in a global temporary table -- MO_GLOB_ORG_ACCESS_TMP. The table is populated based on the MO: Security Profile and MO: Operating Unit profile option values.

Org_security() This returns a sql predicate (where clause) that controls which records can be accessed.

Example:

EXISTS (SELECT 1

FROM mo_glob_org_access_tmp oa

WHERE oa.organization_id = org_id)

This is used in dbms_rls.add_policy to add the vpd security to synonyms.

Check_access() Checks to see if an org can be accessed by a user. If access mode is M (Multiple), see if the org_id is in mo_glob_org_access_tmp.

To Set Policy Context at VPD

Single-org:

Execute mo_global.set_policy_context('S',&org_id);

Multi-org:

Begin

FND_GLOBAL.apps_initialize(

l_user_id, -- User id

l_resp_id, -- Responsibility Id

200); -- Application Id

MO_GLOBAL.init('SQLAP');

End;

MOAC functionality is provided through the MO_GLOBAL package (AFMOGBLB.pls). Following are some of the more important functions and procedures in the package.

Init() This is generally called by forms and reports to setup the list of orgs that can be accessed. It calls the set_org_access procedure, which in turn calls populate_orgs. This inserts the orgs a user is allowed to access in a global temporary table -- MO_GLOB_ORG_ACCESS_TMP. The table is populated based on the MO: Security Profile and MO: Operating Unit profile option values.

Org_security() This returns a sql predicate (where clause) that controls which records can be accessed.

Example:

EXISTS (SELECT 1

FROM mo_glob_org_access_tmp oa

WHERE oa.organization_id = org_id)

This is used in dbms_rls.add_policy to add the vpd security to synonyms.

Check_access() Checks to see if an org can be accessed by a user. If access mode is M (Multiple), see if the org_id is in mo_glob_org_access_tmp.

To Set Policy Context at VPD

Single-org:

Execute mo_global.set_policy_context('S',&org_id);

Multi-org:

Begin

FND_GLOBAL.apps_initialize(

l_user_id, -- User id

l_resp_id, -- Responsibility Id

200); -- Application Id

MO_GLOBAL.init('SQLAP');

End;

R12 Multi-Org Access Control (MOAC)

'Multi-Org Access Control' popularly known as 'MOAC' in short form is a enhanced feature in Release 12. MOAC will enable users to access secured data in one or more Operating Units from a single responsibility.

End-Users can access/transact data within several operating units based on Security Profile attached to a responsibility. i.e. End-Users can access/transact data on multiple Operating units by accessing one operating unit at a time without changing a responsibility. This Provides flexibility for end-users to work conveniently with multiple Operating Units in shared service Environments with single responsibility.

Profile Options which take major Role in MOAC

MO: Security Profile

MO: Default Operating Unit(Optional)

MO: Operating Unit(Mandatory for only Single Org or if MO: Security Profile is not defined)

MOAC Configuration

1. Define Operating Units

Navigation Path:

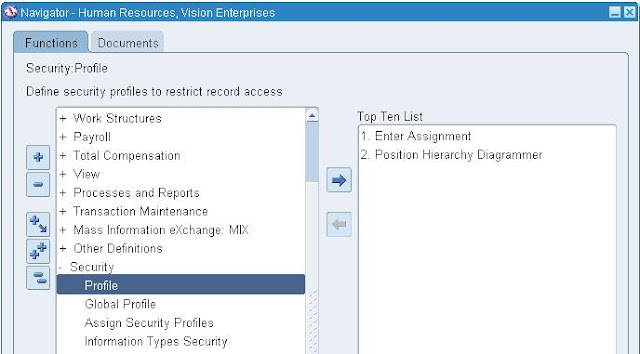

2.Define Security Profile

Navigation Path: HRMS Management responsibility->Security

Security Profile: Allows you to assign multiple operating units for the same business group.

Global Security Profile: Allows you to assign multiple operating units across business groups.

Choose a Security Profile menu item.

1.Enter a unique name for the security profile.

2.There are 4 security types:

3.Check the Exclude Business Group check box to remove the business group in the list of organizations.

4.Use the Classification field to limit the LOV in the Organization Name field. For example, if you select the Classification to Operating Unit, only Operating Units would display for the LOV in the 'Organization Name' field.

5.In the organization name field, select the Operating Unit for which you want access. Repeat this step until you have included all organizations that you need access.

Seeded Security Profiles

3.Run concurrent program "Security List Maintenance Program" from the standard request submission form. The "Security List Maintenance Program" could be preferably run for one named security profile to prevent disturbing other security profile setup.

4.Assign MO: Security Profile

Navigate to System Administrator Responsibility->System Profile OptionsAssign the security profile to MO: Security Profile profile option for your responsibility or user.

5.Assign MO: Default Operating Unit(Optional)

Navigate to System Administrator Responsibility->System Profile Options

Assign the default Operating unit to MO: Default Operating Unit profile option for your responsibility or user.

6.Assign MO: Operating Unit(Mandatory for only Single Org or if MO: Security Profile is not defined)

Navigate to System Administrator Responsibility->System Profile OptionsAssign the Operating unit to MO: Operating Unit profile option for your responsibility or user.

If both 'MO: Security Profile' and 'MO: Operating Unit' are defined at a responsibility level then 'MO: Operating Unit' will be ignored and 'MO: Security Profile' will be effective.

Now you can see multiple operating units in below MOAC enabled form

End-Users can access/transact data within several operating units based on Security Profile attached to a responsibility. i.e. End-Users can access/transact data on multiple Operating units by accessing one operating unit at a time without changing a responsibility. This Provides flexibility for end-users to work conveniently with multiple Operating Units in shared service Environments with single responsibility.

Profile Options which take major Role in MOAC

MO: Security Profile

MO: Default Operating Unit(Optional)

MO: Operating Unit(Mandatory for only Single Org or if MO: Security Profile is not defined)

MOAC Configuration

1. Define Operating Units

Navigation Path:

2.Define Security Profile

Navigation Path: HRMS Management responsibility->Security

Security Profile: Allows you to assign multiple operating units for the same business group.

Global Security Profile: Allows you to assign multiple operating units across business groups.

Choose a Security Profile menu item.

1.Enter a unique name for the security profile.

2.There are 4 security types:

- View all organizations – generally the application will not let you save a new security profile with this setting because it automatically seeds one and there is no point to create another.

- Secure organizations by organization hierarchy and/or organization list – This lets you define a hierarchy to be accessed and to exclude operating units from that hierarchy or include them from outside the hierarchy. You can also just list operating units without designating a hierarchy.

- Secure organizations by single operating unit – In this case the operating unit will be determined using the operating unit specified in the MO:Operating Unit profile option.

- Secure organizations by operating unit and inventory organizations – Here the operating unit will also be determined using the operating unit specified in the MO:Operating Unit profile option.

3.Check the Exclude Business Group check box to remove the business group in the list of organizations.

4.Use the Classification field to limit the LOV in the Organization Name field. For example, if you select the Classification to Operating Unit, only Operating Units would display for the LOV in the 'Organization Name' field.

5.In the organization name field, select the Operating Unit for which you want access. Repeat this step until you have included all organizations that you need access.

Seeded Security Profiles

- One for each business group that allows access to each org in the business group. This has the same name as the business group. Since this allows access within a business group, it is in the security profile form.

- One that allows access to all orgs. This is named like Global Vision. Since it allows access across business groups, it is in the global security profile form.

3.Run concurrent program "Security List Maintenance Program" from the standard request submission form. The "Security List Maintenance Program" could be preferably run for one named security profile to prevent disturbing other security profile setup.

4.Assign MO: Security Profile

Navigate to System Administrator Responsibility->System Profile OptionsAssign the security profile to MO: Security Profile profile option for your responsibility or user.

5.Assign MO: Default Operating Unit(Optional)

Navigate to System Administrator Responsibility->System Profile Options

Assign the default Operating unit to MO: Default Operating Unit profile option for your responsibility or user.

6.Assign MO: Operating Unit(Mandatory for only Single Org or if MO: Security Profile is not defined)

Navigate to System Administrator Responsibility->System Profile OptionsAssign the Operating unit to MO: Operating Unit profile option for your responsibility or user.

If both 'MO: Security Profile' and 'MO: Operating Unit' are defined at a responsibility level then 'MO: Operating Unit' will be ignored and 'MO: Security Profile' will be effective.

Now you can see multiple operating units in below MOAC enabled form

Wednesday, November 25, 2009

R12 Payment Process Request(PPR) in Payment Manager

In 11i, we used Payment Batches to pay multiple invoices same time. In R12, PPR is the replacement for 11i Payment Batches. Release 12 payment setup enables a Payment Administrator to select multiple invoices for payment by selection criteria and he can pause the invoice selection and payment build process . During the invoice selection review, payment manager can review the selected invoices, the invoices that met the criteria but were either not validated or were not approved and hence did not get included in the payment process request. He can adjust the invoice selection by adding or removing the invoices and can also review the cash requirements. While reviewing the payments, payment manager can dismiss individual documents or payments if necessary, and restart the payment build process.

Frequently Used Terms..

Oracle Payments

Oracle Payments is an e-Business Suite module Payables will leverage to group invoices into payments, create instructions, and print or communicate with the bank. Payment Manager(OA page) is the function you can access it from Payables respondibilty.

Navigation Path: Payables->Payments:Entry->Payment Manager

Pay Run

A business action to select multiple invoices on a regular basis to be processed for payment. This may also be referred to as creating and processing payment batches and, in this release, managing a payment process request through completion

Payment Process Request

The payment process request is the selection of invoices into a group for payment processing.

Payment Instruction

Information compiled from one or more payment process requests that is formatted and either transmitted to a financial institution for payment or used in-house to print check documents..

Template

Templates provide a way to store section criteria, payment attributes, and processing rules that can be reused for single pay runs or scheduled pay runs.

Payment Manger Page

There are five tabs under payment manger.

1.Home

The Home tab on Payment Manager Dashboard presents the useful information for a Payment Manager to:

#Monitor the progress of the recent pay run processes

#Highlight any payment processes that require attention and automatically prompt to take appropriate actions.

#Shortcuts and Tabs for initiating, reviewing and adjusting proposed funds disbursements

2.Templates

Using Payment Manager dashboard, a Payment Manager can perform all the tasks associated with pay run process. In the Template tab he can click the “Create” button to create new templates. He can also query a

template and then use it to submit or schedule the payment process requests and run cash requirements before a pay run.

3.Payment Process Requests(PPR)

Payment Process Requests tab can be used to submit a single payment process request or schedule the repeating payment process requests. The pending action on the payment process request can be performed

using “Start Action” icon and the payment request can be cancelled using “Cancel” icon. Clicking on the Payment Process request name, payment manager can drill down to the details.

#Process Automation tab in PPR

The pay run process itself provides for processing steps that you can pause for review based on your needs. In Process Automation tab, the payment manager can specify up front whether the pay run process should

pause for review or if the payment process will be fully automated. Of course, if issues arise during processing that require user input, the process will pause regardless of these options.

##Processing options in Process Automation tab

###Maximize Credits: If Maximize Credits checkbox is enabled then during invoice selection, if there is any credit for a payee, after interest and payment withholding calculations the system will group all scheduled payments for the payee site together to be paid on one payment, and if the sum is negative, the system will reduce the credit amount so the sum is zero.

###Stop Process for Review After Scheduled Payment Selection

###Calculate Payment Withholding and Interest During Scheduled Payment Selection

###Stop Process for Review After Creation of Proposed Payments

###Create Payment Instructions option

If the user wants immediate payment instructions creation, the user can set this option to start the payment instruction program immediately when the payment process request has a Completed status. This option has

an additional function: It ensures that payments from this payment process request will not be combined with payments from other payment process requests when the system builds the payment instructions.

Or,

the user can set the option to wait until the Payment Instruction Program is submitted, typically, in this case an enterprise would schedule the Payment Instruction Program to run periodically. An enterprise would choose this option to take all built payments from multiple payment process requests and build fewer payment instructions.

4.Payment Instructions

Payment Manager can use the Payment Instructions tab to review the status of the payment instructions and if required, can perform any subsequent actions. He can also drill down into the details of the payment instruction and can void all the payments in the instruction.

5.Payments

Payment Manager can use the Payments tab to review the status of the payments created by his payment process requests. He can also can drill down into the details of the payments to stop or void the payments.

Steps in Pay Run Process

Managing a Pay Run involves 3 main processes:

1)Selection of the invoices for payment

2)Grouping the invoices into payments

3)Building the payment instruction files to either print checks or send instructions to the bank.

Follow red mark numbers in the picture to get the sequence of process steps in Pay Run Process

After user submits PPR, the Payment Process request completes with the status “Invoices Pending Review” if it has been configured to pause after the invoice selection. Clicking on “Start Action” icon navigates the user to the “Selected Scheduled Payments” page.

On the “Selected Scheduled Payments” page, Payment Manager can review the total count of selected scheduled payments. Amount remaining , discounts, payment amount, and interest due can also be reviewed for each currency in the payment process request.

The page also lists all the invoices along with their details. Payment Manager can add or remove the scheduled payments or modify the Discounts and payment amounts.

Clicking on the “View Unselected” takes the Payment Manager to a “Unselected Scheduled Payments” page that gives the following information:

Counts for invoices that were never validated and that failed validations

Counts for invoices that require approval and where approval is rejected

Counts of invoices on Scheduled Payment Hold and Supplier Site hold

Counts where Payee total is zero or less and where Discount rate is too low

Count of Unselected Payment Schedules, Total Amount, and Discount per currency

List of Invoices with invoice information and reason for not getting selected

Payment Manager can add more Scheduled Payments by clicking on the “Add Scheduled Payments”, and choosing the search criteria for the documents payables from the list of values.

Once the Payment Manager is done reviewing the payment process request, he can click on the “Submit” button to initiate the Payment creation process. This action also generates the Scheduled Payment Selection

Report again.

The Payment Process will complete with the status “Information Required – Pending Action” if certain information required for the payment creation was missing on scheduled payments. Clicking on “Start Action” icon navigates the user to the “Complete Document Assignments” page.

2.Grouping into Payments

The Payment Process request completes with the status “Pending Proposed Payment Review” if it has been configured to pause after the creation of proposed payments. The payment process request also displays the count for documents that were rejected during payment creation. Clicking on “Start Action” icon navigates the user to the “Review Proposed Payments” page.

In the Review Proposed Payments page, payment manager can review the payment information for the selected scheduled payments.

After reviewing, payment manager can then specify the action “Run Payment Process” to submit the Payment build process. After this action, the payment process request has the status of “Assembled Payments”.

Payment Manager can drill down to view payment details by clicking on the Payment Process request link. He can view the number of payments, documents, and Total Payment Amount per currency. Individual payments are also listed along with more information. By selecting the radio button of a payment, payment manager can view the scheduled payments that got included in that payment.

Clicking on “Rejected and Removed Items”, Payment manager can navigate to see the details for scheduled payments that got rejected/removed.

Rejected and Removed Items page lists the rejected document payables, and clicking on the reference number link you can view the details of the document and the reason it got rejected.

3.Building Payment Instructions

For creating Printed payment instructions, Payment Manager can specify the criteria for selecting payments and printing information. The criteria can include the Payment Process profile, Currency, Internal Bank Account, Payment Document, Payment Process Request, etc.

Frequently Used Terms..

Oracle Payments

Oracle Payments is an e-Business Suite module Payables will leverage to group invoices into payments, create instructions, and print or communicate with the bank. Payment Manager(OA page) is the function you can access it from Payables respondibilty.

Navigation Path: Payables->Payments:Entry->Payment Manager

Pay Run

A business action to select multiple invoices on a regular basis to be processed for payment. This may also be referred to as creating and processing payment batches and, in this release, managing a payment process request through completion

Payment Process Request

The payment process request is the selection of invoices into a group for payment processing.

Payment Instruction

Information compiled from one or more payment process requests that is formatted and either transmitted to a financial institution for payment or used in-house to print check documents..

Template

Templates provide a way to store section criteria, payment attributes, and processing rules that can be reused for single pay runs or scheduled pay runs.

Payment Manger Page

There are five tabs under payment manger.

1.Home

The Home tab on Payment Manager Dashboard presents the useful information for a Payment Manager to:

#Monitor the progress of the recent pay run processes

#Highlight any payment processes that require attention and automatically prompt to take appropriate actions.

#Shortcuts and Tabs for initiating, reviewing and adjusting proposed funds disbursements

2.Templates

Using Payment Manager dashboard, a Payment Manager can perform all the tasks associated with pay run process. In the Template tab he can click the “Create” button to create new templates. He can also query a

template and then use it to submit or schedule the payment process requests and run cash requirements before a pay run.

3.Payment Process Requests(PPR)

Payment Process Requests tab can be used to submit a single payment process request or schedule the repeating payment process requests. The pending action on the payment process request can be performed

using “Start Action” icon and the payment request can be cancelled using “Cancel” icon. Clicking on the Payment Process request name, payment manager can drill down to the details.

#Process Automation tab in PPR

The pay run process itself provides for processing steps that you can pause for review based on your needs. In Process Automation tab, the payment manager can specify up front whether the pay run process should

pause for review or if the payment process will be fully automated. Of course, if issues arise during processing that require user input, the process will pause regardless of these options.

##Processing options in Process Automation tab

###Maximize Credits: If Maximize Credits checkbox is enabled then during invoice selection, if there is any credit for a payee, after interest and payment withholding calculations the system will group all scheduled payments for the payee site together to be paid on one payment, and if the sum is negative, the system will reduce the credit amount so the sum is zero.

###Stop Process for Review After Scheduled Payment Selection

###Calculate Payment Withholding and Interest During Scheduled Payment Selection

###Stop Process for Review After Creation of Proposed Payments

###Create Payment Instructions option

If the user wants immediate payment instructions creation, the user can set this option to start the payment instruction program immediately when the payment process request has a Completed status. This option has

an additional function: It ensures that payments from this payment process request will not be combined with payments from other payment process requests when the system builds the payment instructions.

Or,

the user can set the option to wait until the Payment Instruction Program is submitted, typically, in this case an enterprise would schedule the Payment Instruction Program to run periodically. An enterprise would choose this option to take all built payments from multiple payment process requests and build fewer payment instructions.

4.Payment Instructions

Payment Manager can use the Payment Instructions tab to review the status of the payment instructions and if required, can perform any subsequent actions. He can also drill down into the details of the payment instruction and can void all the payments in the instruction.

5.Payments

Payment Manager can use the Payments tab to review the status of the payments created by his payment process requests. He can also can drill down into the details of the payments to stop or void the payments.

Steps in Pay Run Process

Managing a Pay Run involves 3 main processes:

1)Selection of the invoices for payment

2)Grouping the invoices into payments

3)Building the payment instruction files to either print checks or send instructions to the bank.

Follow red mark numbers in the picture to get the sequence of process steps in Pay Run Process

Pay Run Process

1. Invoice SelectionAfter user submits PPR, the Payment Process request completes with the status “Invoices Pending Review” if it has been configured to pause after the invoice selection. Clicking on “Start Action” icon navigates the user to the “Selected Scheduled Payments” page.

On the “Selected Scheduled Payments” page, Payment Manager can review the total count of selected scheduled payments. Amount remaining , discounts, payment amount, and interest due can also be reviewed for each currency in the payment process request.

The page also lists all the invoices along with their details. Payment Manager can add or remove the scheduled payments or modify the Discounts and payment amounts.

Clicking on the “View Unselected” takes the Payment Manager to a “Unselected Scheduled Payments” page that gives the following information:

Counts for invoices that were never validated and that failed validations

Counts for invoices that require approval and where approval is rejected

Counts of invoices on Scheduled Payment Hold and Supplier Site hold

Counts where Payee total is zero or less and where Discount rate is too low

Count of Unselected Payment Schedules, Total Amount, and Discount per currency

List of Invoices with invoice information and reason for not getting selected

Payment Manager can add more Scheduled Payments by clicking on the “Add Scheduled Payments”, and choosing the search criteria for the documents payables from the list of values.

Once the Payment Manager is done reviewing the payment process request, he can click on the “Submit” button to initiate the Payment creation process. This action also generates the Scheduled Payment Selection

Report again.

The Payment Process will complete with the status “Information Required – Pending Action” if certain information required for the payment creation was missing on scheduled payments. Clicking on “Start Action” icon navigates the user to the “Complete Document Assignments” page.

2.Grouping into Payments

The Payment Process request completes with the status “Pending Proposed Payment Review” if it has been configured to pause after the creation of proposed payments. The payment process request also displays the count for documents that were rejected during payment creation. Clicking on “Start Action” icon navigates the user to the “Review Proposed Payments” page.

In the Review Proposed Payments page, payment manager can review the payment information for the selected scheduled payments.

After reviewing, payment manager can then specify the action “Run Payment Process” to submit the Payment build process. After this action, the payment process request has the status of “Assembled Payments”.

Payment Manager can drill down to view payment details by clicking on the Payment Process request link. He can view the number of payments, documents, and Total Payment Amount per currency. Individual payments are also listed along with more information. By selecting the radio button of a payment, payment manager can view the scheduled payments that got included in that payment.

Clicking on “Rejected and Removed Items”, Payment manager can navigate to see the details for scheduled payments that got rejected/removed.

Rejected and Removed Items page lists the rejected document payables, and clicking on the reference number link you can view the details of the document and the reason it got rejected.

3.Building Payment Instructions

For creating Printed payment instructions, Payment Manager can specify the criteria for selecting payments and printing information. The criteria can include the Payment Process profile, Currency, Internal Bank Account, Payment Document, Payment Process Request, etc.

Tuesday, November 24, 2009

Oracle Procure to Pay Process

I. P2P Process and Imp Stages

II. More Detail About Each Step in the P2P Process

III. Basic Steps to Create P2P Process

I. P2P Process and Imp Stages

1.Demand

The procurement process generates and manages requests for the purchase of goods. The demand for purchase items may be a one-time event or may recur in either predictable or random time intervals.

2.Source

The procurement sourcing process covers the business activities related to the search, qualification, and selection of suitable suppliers for requested goods and services.

3.Order

The procurement ordering process includes purchase order placement by the buying organization and purchase order execution by the supplying organization.

4.Receive

The receipt process acknowledges that a purchase order has been duly executed. For orders of physical goods, it will typically include the receipt, inspection and delivery of the goods to inventory or to another designated location. For orders of services, it will typically consist of a notification from the requester or the approving person that the service has been performed as agreed.

5.Pay

The payment process consists of those activities involved in the payment for ordered goods and services.

II. More Detail About Each Step in the P2P Process

1.Requisitions(Demand)

Requisitions represent demand for goods or services. With online requisitions, you can centralize your purchasing department, source your requisition with the best suppliers, and ensure that you obtain the appropriate management approval before creating purchase orders from requisitions.

Requisitions for goods and services:

Are generated by applications like Inventory, Work in Process (WIP), Advanced Supply Chain Planning (ASCP) and Order Management

May be entered manually through Oracle Purchasing windows

May be entered using Oracle iProcurement

May be imported from external systems

With Oracle Purchasing, you can:

Create, edit, and review requisition information on-line.

Review the current status and action history of your requisitions. You should always know who approves requisitions and whether they are in the approval, purchasing, receiving, or delivery stage.

Source goods from your own inventory with internal requisitions.

2.RFQs and Quotations(Source)

Oracle Purchasing provides you with request for quotation (RFQ), and quotation features to handle your sourcing needs. You can create an RFQ from requisitions, match supplier quotations to your RFQ, and automatically copy quotation information to purchase orders.

Quotations can be:

Entered manually

Copied from an RFQ

Imported using the Purchasing Documents Open Interface

Imported using the e-Commerce Gateway

With Oracle Purchasing, you can:

Identify requisitions that require supplier quotations and automatically create an RFQ.

Create an RFQ with or without approved requisitions so that you can plan ahead for your future procurement requirements.

Record supplier quotations from a catalog, telephone conversation, or response from your request for quotation. You can also receive quotations electronically.

Review, analyze, and approve supplier quotations that you want available to reference on purchase orders and requisitions. You should be able to evaluate your suppliers based on quotation information.

Receive automatic notification when a quotation or request for quotation approaches expiration.

Review quotation information online when creating purchase orders or requisitions and copy specific quotation information to a purchase order or requisition.

3.Suppliers

You must define a supplier before performing most activities within Oracle Purchasing and Payables.

You optionally enter a recommended supplier on a requisition.

You need a supplier to issue a request for quotation.

You use that same supplier when you enter a quotation.

You need supplier information for purchase orders.

You receive goods or services from suppliers.

You return goods to suppliers.

You must pay the supplier for the goods or services purchased.

Set up suppliers to record information about individuals and companies you purchase goods and services from. You can also enter employees you reimburse for expense reports. You can designate supplier sites as pay sites, purchasing sites, RFQ only sites, or procurement card sites. For example, for a single supplier, you can buy from several different sites and send payments to several different sites. Most supplier information automatically defaults to all supplier sites to facilitate supplier site entry. However, you can override these defaults and have unique information for each site.

4.Purchase Orders(Order)

Oracle Purchasing supports four types of purchase orders: standard, blanket, contract and planned. There are several methods that can be used to create purchase orders. You can manually create purchase orders or search approved requisitions and add them to purchase orders. Standard purchase orders can be imported through the Purchasing Documents Open Interface in a status of Incomplete or Approved. You can automate purchase document creation using the PO Create Documents workflow to automatically create a blanket purchase agreement release or a standard purchase order upon approval of a requisition.

Once purchase orders are created, they may be submitted for approval. The approval process checks to see if the submitter has sufficient authority to approve the purchase order. Once the document is approved, it may be sent to your supplier using a variety of methods including: printed document, EDI, fax, e-mail, Oracle iSupplier Portal and XML. Once the purchase order or release is sent to your supplier, they are authorized to ship goods at the times and to the locations that have been agreed upon.

Purchase documents may be created:

By buyers using the AutoCreate window

By importing them using the Purchasing Documents Open Interface

Automatically, by the Create Releases program (blanket releases)

Automatically, by Workflow (blanket releases or standard purchase orders)

With Oracle Purchasing, you can:

Review all of your purchases with your suppliers to negotiate better discounts.

Create purchase orders simply by entering a supplier and item details.

Create standard purchase orders and blanket releases from both on-line and paper requisitions.

Create accurate and detailed accounting information so that you charge purchases to the appropriate departments.

Review the status and history of your purchase orders at any time for all the information you need.

Record supplier acceptances of your purchase orders. You always know whether your suppliers have received and accepted your purchase order terms and conditions.

Copy existing purchase orders.

Manage global supplier agreements (blankets and contracts) from a centralized business unit.

Manage approved contractual terminology from a library of terms using Oracle Procurement Contracts.

5.Receiving(Receive)

Using Oracle Purchasing, you can process receipts from suppliers, receipts from other warehouses or inventory organizations, in-transit shipments and receipts due to customer returns. You can search for expected receipts based on a purchase order or a customer return recorded in Oracle Order Management and then process them to their final destination whether it is inventory, expense or shop floor. Oracle Purchasing lets you control the items you order through receiving, inspection, transfer, and internal delivery. You can use these features to indicate the quantity, quality, and internal delivery of the items you receive.

With Oracle Purchasing, you can:

Use routing controls at the organization, supplier, item, or order level to enforce material movement through receiving. For example, you can require inspection for some items and dock-to-stock receipt for others.

Define receiving tolerances at the organization, supplier, item, and order level, with the lowest level overriding previous levels. You can define tolerances for receipt quantity, on-time delivery, and receiving location.

Use blind receiving to improve accuracy in the receiving process. With this option, the quantity due for each shipment does not show and quantity control tolerances are ignored. Use Express and Cascade receiving to process certain types of receipts more quickly.

With Oracle iProcurement, you can:

Receive orders from your desktop, bypassing the need for receiving department interaction.

6.Invoicing(Pay)

Once you’ve received goods or service from your supplier, you’ll also receive an invoice. Using Oracle Payables you can record invoices in a number of different ways.

With Oracle Payables you can:

Enter invoices manually, either individually or in batches.

Use the Invoice Gateway for rapid, high-volume entry of standard invoices and credit memos that are not complex and do not require extensive online validation.

Automate invoice creation for periodic invoices using the Recurring Invoice functionality.

Use Oracle iExpenses to enter employee expense reports using a web browser.

Record credit card/procurement card invoices from transactions the credit card issuer sends to you in a flat file.

Record Oracle Project related expense reports.

Import EDI invoices processed with the Oracle e-Commerce Gateway.

Import lease invoices transferred from Oracle Property Manager.

Match invoices to purchase orders to ensure you only pay what you’re supposed to be paying for.

7.Payment

Once invoices have been validated, they can be selected for payment. Oracle Payables provides the information that you need to make effective payment decisions, stay in control of payments to suppliers and employees, and keep your accounting records up-to-date so that you always know your cash position. Oracle Payables handles every form of payment, including checks, manual payments, wire transfers, EDI payments, bank drafts, and electronic funds transfers. Oracle Payables is integrated with Oracle Cash Management to support automatic or manual reconciliation of your payments with bank statements sent by the bank.

With Oracle Payables, you can:

Ensure duplicate invoice payments never occur.

Pay only invoices that are due, and automatically take the maximum discount available.

Select invoices for payment using a wide variety of criteria.

Record stop payments

Record void payments

Review information on line on the status of every payment

Process positive pay.

III. Basic Steps to Create P2P Process

1.Enter supplier information

2.Enter Purchase Requisitions

Create Purchase requisition (PR) for the Purchased items

Navigation Path: Purchasing Responsibility->Requisitions->Requisitions

Enter item details one by one. Open Distributions form and provide charge account. Go back to the main form and give it for approval.

To check it is approved or not:

Go to the Requisition Summary from and provide Requisition number.

Navigation Path : Purchasing Responsibility->Requisitions->Requisition Summary

3.Create Purchase Orders

Create Purchase Order from the Purchase Requisition created above. We have auto-create Purchase order option to create Purchase Order (PO) from Purchase Requisition (PR). Using Auto-create also there are two Options to create Purchase order.

Manual or Automatic

Manual way:

Navigation Path : Purchasing Responsibility->Auto-create Form

Click on the form and enter Purchase Requisition (PR) number and click on Find Button. This Opens auto-create Documents form. Choose the checkbox against the each of the item and click on manual button. This opens the form New Document Form. Provide Supplier name and click create Button. It creates a Document Builder in Autocreate Documents Form. Choose Item one by one and click on Add to document Button. This will add each Item to Document Builder Tab. After adding all the Items click on Create button in the Bottom. This crates PO and shows message with PO Number.

Open PO. This will be in Incomplete status. Click Shipments button and open the form. Here you can set Receipt Routing. Go to More tab in the same form. Here you can set Match Approval level. In same form click on Receiving Controls button and open the form. Here you can set receipt Routing(Direct Delivery/Inspection Required/Standard receipt).

Automatic way:

Navigation Path: Purchasing Responsibility->Auto-create Form

Click on the form and enter Purchase Requisition (PR) number and click on Find Button. This Opens auto-create Documents form. Choose the checkbox against the each of the item and click on Automatic button.

It opens the New Documents form. Click on Create Button. It creates a new PO with status of Incomplete. Perform required modification to the Match Approval Level and Receipt Routing. Approve PO.

You can also create PO without matching Purchase Requisition (PR).

4.Create Receipts(When you receive inventory against PO)

Navigation Path: Purchasing responsibility->Receiving->Receipts

Click on the Receipts Form and enter the PO Number and click on find button. Receipt Header Form Opens(Keep New receipt redio button checked). Click on Receipts form. Select all Items on the Left-hand side check Box and Save the record. Click on the Header Button to note down the Receipt Number.

5.Auto-Create Supplier Invoice

We have to run Pay on Receipt Program to create self Billing Invoices for Receipts we created.

Navigation Path: Purchasing Responsibility->Requests

Run CP for Pay on Receipts Autoinvoice Program. Provide Receipt number in parameters windo of CP. Check the output and note down Invoice Number that has beed created.

6.Create PO Match Invoice

Navigation Path: Payables responsibility->Invoices->Invoices

Provide invoice header level information in invoice workbench. Click on Match button. Provide PO Number and click find. Here select match check box for shipments you want to match to Invoice. Click Match button. This creates distributions for selected shipments. Open Actions form and validate and approve the invoice.

7.Invoice Accounting

From Invoice workbench, open Actions form and select Create Accounting. This creates accounting entries for invoice. Click on Tools Menu and view Accounting to view the accounting entries Created.

8.Payment

Click on Actions Button from the Invoice Screen to make Payment for the Invoice. In Invoice Actions Button enable Pay in full check Box and click Ok. Payments Window opens up. Choose the Type as Quick and choose the Bank account and Document Type and save the Record. Payment Document Generated for this record.

9.Payment Accounting

We need to Account for the Check Payment what have been made.

Navigation Path: Accounts Payables->Payments->Entry->Payments

Click on the Payment form and Query for the Document Number. Click on Actions Button and Enable the Create Accounting Check Box and Click Ok button. Click on Tools Menu to view the Accounting Entries created for the Payment

II. More Detail About Each Step in the P2P Process

III. Basic Steps to Create P2P Process

I. P2P Process and Imp Stages

1.Demand

The procurement process generates and manages requests for the purchase of goods. The demand for purchase items may be a one-time event or may recur in either predictable or random time intervals.

2.Source

The procurement sourcing process covers the business activities related to the search, qualification, and selection of suitable suppliers for requested goods and services.

3.Order

The procurement ordering process includes purchase order placement by the buying organization and purchase order execution by the supplying organization.

4.Receive

The receipt process acknowledges that a purchase order has been duly executed. For orders of physical goods, it will typically include the receipt, inspection and delivery of the goods to inventory or to another designated location. For orders of services, it will typically consist of a notification from the requester or the approving person that the service has been performed as agreed.

5.Pay

The payment process consists of those activities involved in the payment for ordered goods and services.

II. More Detail About Each Step in the P2P Process

1.Requisitions(Demand)

Requisitions represent demand for goods or services. With online requisitions, you can centralize your purchasing department, source your requisition with the best suppliers, and ensure that you obtain the appropriate management approval before creating purchase orders from requisitions.

Requisitions for goods and services:

Are generated by applications like Inventory, Work in Process (WIP), Advanced Supply Chain Planning (ASCP) and Order Management

May be entered manually through Oracle Purchasing windows

May be entered using Oracle iProcurement

May be imported from external systems

With Oracle Purchasing, you can:

Create, edit, and review requisition information on-line.

Review the current status and action history of your requisitions. You should always know who approves requisitions and whether they are in the approval, purchasing, receiving, or delivery stage.

Source goods from your own inventory with internal requisitions.

2.RFQs and Quotations(Source)

Oracle Purchasing provides you with request for quotation (RFQ), and quotation features to handle your sourcing needs. You can create an RFQ from requisitions, match supplier quotations to your RFQ, and automatically copy quotation information to purchase orders.

Quotations can be:

Entered manually

Copied from an RFQ

Imported using the Purchasing Documents Open Interface

Imported using the e-Commerce Gateway

With Oracle Purchasing, you can:

Identify requisitions that require supplier quotations and automatically create an RFQ.

Create an RFQ with or without approved requisitions so that you can plan ahead for your future procurement requirements.

Record supplier quotations from a catalog, telephone conversation, or response from your request for quotation. You can also receive quotations electronically.

Review, analyze, and approve supplier quotations that you want available to reference on purchase orders and requisitions. You should be able to evaluate your suppliers based on quotation information.

Receive automatic notification when a quotation or request for quotation approaches expiration.

Review quotation information online when creating purchase orders or requisitions and copy specific quotation information to a purchase order or requisition.

3.Suppliers

You must define a supplier before performing most activities within Oracle Purchasing and Payables.

You optionally enter a recommended supplier on a requisition.

You need a supplier to issue a request for quotation.

You use that same supplier when you enter a quotation.

You need supplier information for purchase orders.

You receive goods or services from suppliers.

You return goods to suppliers.

You must pay the supplier for the goods or services purchased.

Set up suppliers to record information about individuals and companies you purchase goods and services from. You can also enter employees you reimburse for expense reports. You can designate supplier sites as pay sites, purchasing sites, RFQ only sites, or procurement card sites. For example, for a single supplier, you can buy from several different sites and send payments to several different sites. Most supplier information automatically defaults to all supplier sites to facilitate supplier site entry. However, you can override these defaults and have unique information for each site.

4.Purchase Orders(Order)

Oracle Purchasing supports four types of purchase orders: standard, blanket, contract and planned. There are several methods that can be used to create purchase orders. You can manually create purchase orders or search approved requisitions and add them to purchase orders. Standard purchase orders can be imported through the Purchasing Documents Open Interface in a status of Incomplete or Approved. You can automate purchase document creation using the PO Create Documents workflow to automatically create a blanket purchase agreement release or a standard purchase order upon approval of a requisition.

Once purchase orders are created, they may be submitted for approval. The approval process checks to see if the submitter has sufficient authority to approve the purchase order. Once the document is approved, it may be sent to your supplier using a variety of methods including: printed document, EDI, fax, e-mail, Oracle iSupplier Portal and XML. Once the purchase order or release is sent to your supplier, they are authorized to ship goods at the times and to the locations that have been agreed upon.

Purchase documents may be created:

By buyers using the AutoCreate window

By importing them using the Purchasing Documents Open Interface

Automatically, by the Create Releases program (blanket releases)

Automatically, by Workflow (blanket releases or standard purchase orders)

With Oracle Purchasing, you can:

Review all of your purchases with your suppliers to negotiate better discounts.

Create purchase orders simply by entering a supplier and item details.

Create standard purchase orders and blanket releases from both on-line and paper requisitions.

Create accurate and detailed accounting information so that you charge purchases to the appropriate departments.

Review the status and history of your purchase orders at any time for all the information you need.

Record supplier acceptances of your purchase orders. You always know whether your suppliers have received and accepted your purchase order terms and conditions.

Copy existing purchase orders.

Manage global supplier agreements (blankets and contracts) from a centralized business unit.

Manage approved contractual terminology from a library of terms using Oracle Procurement Contracts.

5.Receiving(Receive)

Using Oracle Purchasing, you can process receipts from suppliers, receipts from other warehouses or inventory organizations, in-transit shipments and receipts due to customer returns. You can search for expected receipts based on a purchase order or a customer return recorded in Oracle Order Management and then process them to their final destination whether it is inventory, expense or shop floor. Oracle Purchasing lets you control the items you order through receiving, inspection, transfer, and internal delivery. You can use these features to indicate the quantity, quality, and internal delivery of the items you receive.

With Oracle Purchasing, you can:

Use routing controls at the organization, supplier, item, or order level to enforce material movement through receiving. For example, you can require inspection for some items and dock-to-stock receipt for others.

Define receiving tolerances at the organization, supplier, item, and order level, with the lowest level overriding previous levels. You can define tolerances for receipt quantity, on-time delivery, and receiving location.

Use blind receiving to improve accuracy in the receiving process. With this option, the quantity due for each shipment does not show and quantity control tolerances are ignored. Use Express and Cascade receiving to process certain types of receipts more quickly.

With Oracle iProcurement, you can:

Receive orders from your desktop, bypassing the need for receiving department interaction.

6.Invoicing(Pay)

Once you’ve received goods or service from your supplier, you’ll also receive an invoice. Using Oracle Payables you can record invoices in a number of different ways.

With Oracle Payables you can:

Enter invoices manually, either individually or in batches.

Use the Invoice Gateway for rapid, high-volume entry of standard invoices and credit memos that are not complex and do not require extensive online validation.

Automate invoice creation for periodic invoices using the Recurring Invoice functionality.

Use Oracle iExpenses to enter employee expense reports using a web browser.

Record credit card/procurement card invoices from transactions the credit card issuer sends to you in a flat file.

Record Oracle Project related expense reports.

Import EDI invoices processed with the Oracle e-Commerce Gateway.

Import lease invoices transferred from Oracle Property Manager.

Match invoices to purchase orders to ensure you only pay what you’re supposed to be paying for.

7.Payment

Once invoices have been validated, they can be selected for payment. Oracle Payables provides the information that you need to make effective payment decisions, stay in control of payments to suppliers and employees, and keep your accounting records up-to-date so that you always know your cash position. Oracle Payables handles every form of payment, including checks, manual payments, wire transfers, EDI payments, bank drafts, and electronic funds transfers. Oracle Payables is integrated with Oracle Cash Management to support automatic or manual reconciliation of your payments with bank statements sent by the bank.

With Oracle Payables, you can:

Ensure duplicate invoice payments never occur.

Pay only invoices that are due, and automatically take the maximum discount available.

Select invoices for payment using a wide variety of criteria.

Record stop payments

Record void payments

Review information on line on the status of every payment

Process positive pay.

III. Basic Steps to Create P2P Process

1.Enter supplier information

2.Enter Purchase Requisitions

Create Purchase requisition (PR) for the Purchased items

Navigation Path: Purchasing Responsibility->Requisitions->Requisitions

Enter item details one by one. Open Distributions form and provide charge account. Go back to the main form and give it for approval.

To check it is approved or not:

Go to the Requisition Summary from and provide Requisition number.

Navigation Path : Purchasing Responsibility->Requisitions->Requisition Summary

3.Create Purchase Orders

Create Purchase Order from the Purchase Requisition created above. We have auto-create Purchase order option to create Purchase Order (PO) from Purchase Requisition (PR). Using Auto-create also there are two Options to create Purchase order.

Manual or Automatic

Manual way:

Navigation Path : Purchasing Responsibility->Auto-create Form

Click on the form and enter Purchase Requisition (PR) number and click on Find Button. This Opens auto-create Documents form. Choose the checkbox against the each of the item and click on manual button. This opens the form New Document Form. Provide Supplier name and click create Button. It creates a Document Builder in Autocreate Documents Form. Choose Item one by one and click on Add to document Button. This will add each Item to Document Builder Tab. After adding all the Items click on Create button in the Bottom. This crates PO and shows message with PO Number.

Open PO. This will be in Incomplete status. Click Shipments button and open the form. Here you can set Receipt Routing. Go to More tab in the same form. Here you can set Match Approval level. In same form click on Receiving Controls button and open the form. Here you can set receipt Routing(Direct Delivery/Inspection Required/Standard receipt).

- Standard Routing: This process will receive the Inventory in main inventory org and you need to do a manual transfer to sub-inventory if we choose this option.

- Direct Delivery: This process delivers the goods directly in sub-inventories.

- Inspection required: This process requires inspection of goods before receiving the goods in the inventory org.

Automatic way:

Navigation Path: Purchasing Responsibility->Auto-create Form

Click on the form and enter Purchase Requisition (PR) number and click on Find Button. This Opens auto-create Documents form. Choose the checkbox against the each of the item and click on Automatic button.

It opens the New Documents form. Click on Create Button. It creates a new PO with status of Incomplete. Perform required modification to the Match Approval Level and Receipt Routing. Approve PO.

You can also create PO without matching Purchase Requisition (PR).

4.Create Receipts(When you receive inventory against PO)

Navigation Path: Purchasing responsibility->Receiving->Receipts

Click on the Receipts Form and enter the PO Number and click on find button. Receipt Header Form Opens(Keep New receipt redio button checked). Click on Receipts form. Select all Items on the Left-hand side check Box and Save the record. Click on the Header Button to note down the Receipt Number.

5.Auto-Create Supplier Invoice

We have to run Pay on Receipt Program to create self Billing Invoices for Receipts we created.

Navigation Path: Purchasing Responsibility->Requests

Run CP for Pay on Receipts Autoinvoice Program. Provide Receipt number in parameters windo of CP. Check the output and note down Invoice Number that has beed created.

6.Create PO Match Invoice

Navigation Path: Payables responsibility->Invoices->Invoices

Provide invoice header level information in invoice workbench. Click on Match button. Provide PO Number and click find. Here select match check box for shipments you want to match to Invoice. Click Match button. This creates distributions for selected shipments. Open Actions form and validate and approve the invoice.

7.Invoice Accounting

From Invoice workbench, open Actions form and select Create Accounting. This creates accounting entries for invoice. Click on Tools Menu and view Accounting to view the accounting entries Created.

8.Payment

Click on Actions Button from the Invoice Screen to make Payment for the Invoice. In Invoice Actions Button enable Pay in full check Box and click Ok. Payments Window opens up. Choose the Type as Quick and choose the Bank account and Document Type and save the Record. Payment Document Generated for this record.

9.Payment Accounting

We need to Account for the Check Payment what have been made.

Navigation Path: Accounts Payables->Payments->Entry->Payments

Click on the Payment form and Query for the Document Number. Click on Actions Button and Enable the Create Accounting Check Box and Click Ok button. Click on Tools Menu to view the Accounting Entries created for the Payment

Purchase Order Types

Purchasing provides the following purchase order types: Standard Purchase Order, Planned Purchase Order, Blanket Purchase Agreement, and Contract Purchase Agreement.

Standard Purchase Orders

You generally create standard purchase orders for one-time purchase of various items. You create standard purchase orders when you know the details of the goods or services you require, estimated costs, quantities, delivery schedules, and accounting distributions.

Blanket Purchase Agreements

You create blanket purchase agreements when you know the detail of the goods or services you plan to buy from a specific supplier in a period, but you do not yet know the detail of your delivery schedules. You can use blanket purchase agreements to specify negotiated prices for your items before actually purchasing them. Blanket purchase agreements can be created for a single organization or to be shared by different business units of your organization (global agreements).

Contract Purchase Agreements

You create contract purchase agreements with your suppliers to agree on specific terms and conditions without indicating the goods and services that you will be purchasing. You can later issue standard purchase orders referencing your contracts.

Planned Purchase Orders

A planned purchase order is a long-term agreement committing to buy items or services from a single source. You must specify tentative delivery schedules and all details for goods or services that you want to buy, including charge account, quantities, and estimated cost.

Standard Purchase Orders

You generally create standard purchase orders for one-time purchase of various items. You create standard purchase orders when you know the details of the goods or services you require, estimated costs, quantities, delivery schedules, and accounting distributions.

Blanket Purchase Agreements

You create blanket purchase agreements when you know the detail of the goods or services you plan to buy from a specific supplier in a period, but you do not yet know the detail of your delivery schedules. You can use blanket purchase agreements to specify negotiated prices for your items before actually purchasing them. Blanket purchase agreements can be created for a single organization or to be shared by different business units of your organization (global agreements).

Contract Purchase Agreements

You create contract purchase agreements with your suppliers to agree on specific terms and conditions without indicating the goods and services that you will be purchasing. You can later issue standard purchase orders referencing your contracts.

Planned Purchase Orders

A planned purchase order is a long-term agreement committing to buy items or services from a single source. You must specify tentative delivery schedules and all details for goods or services that you want to buy, including charge account, quantities, and estimated cost.

Monday, November 23, 2009

Accounting and Reconciliation Reports in AP

• Accounts Payable Trial Balance Report

• Accounts Payable Negative Supplier Balance Report

• Period Close Exceptions Report

• Posted Invoice Register

• Posted Payment Register

• Unaccounted Transactions Report

Accounts Payable Trial Balance Report

Use the Accounts Payable Trial Balance Report to verify that total accounts payable liabilities in Payables equal those in the general ledger. To reconcile these balances you can compare the cumulative total liability provided by this report with the total liability provided by your general ledger. The Accounts Payable Trial Balance report is a Payables-specific version of the Open Account Balances Listing report. By running this report from Payables, you can run this report for a specific operating unit.

Accounts Payable Negative Supplier Balance Report

The Accounts Payable Negative Supplier Balance report allows you to run a Payables-specific version of the Open Account Balances Listing report. By running this report from Payables, you can view the negative supplier balances for a specific operating unit.

Period Close Exceptions Report

Submit this report to review a complete list of exceptions that are preventing you from closing a Payables accounting period. This report lists, for each organization within the ledger, the following exceptions:

• Outstanding Payment Batches

• Accounting Entries not Transferred to General Ledger

• Bills Payable Requiring Maturity Event and Accounting

• Unaccounted Invoices

• Unaccounted Payments

Posted Invoice Register

Use the Posted Invoice Register to review accounting lines for invoices that have been transferred to your general ledger. Because it presents amounts that have been charged to liability accounts, this report is valid only for an accrual ledger.

The Posted Invoice Register is primarily a reconciliation tool. Use this report along with the Posted Payment Register and the Accounts Payable Trial Balance Report to reconcile balances between Payables and your general ledger. To make their output easier to read, each of these reports can be generated for a single liability account. For example, if you are using Automatic Offsets and the liability for your invoices is allocated across multiple balancing segments, then you can use the Liability Account parameter to limit your reports to a single balancing organization.

You can generate the report in summary or in detail. When generated in detail, the report displays invoices charged to liability accounts and the accounting information that has been transferred to the general ledger. Also included is the supplier and amount information for each invoice listed. Payables displays the total invoice amount in the invoice currency, and the transferred distribution amount in both the invoice currency and accounted currency for easier reconciliation with your general ledger.

Posted Payment Register